Cash Loans in Batesville, MS

At Family Financial Services Inc., we offer quick and easy loan approvals in just 1 hour, with amounts ranging from $500 to $15,000. With over 35 years of experience, our family-owned and operated business is dedicated to serving Batesville, Corinth, MS and everywhere in between.

Over 35 years

We have over three decades of experience, bringing extensive knowledge to meet your financial needs.

1-Hour Loan Approval

Our fast loan approval process ensures you get the funds you need quick.

Local, Family-Owned

As a local, family-owned business, we offer personalized service with a strong community connection.

Courteous Staff

Our professional and courteous staff are dedicated to providing exceptional customer service, ensuring you feel valued and respected.

A good credit score is crucial for securing favorable loan terms, including lower interest rates and better repayment options. If you're planning to apply for a loan in Batesville, Mississippi, improving your credit score beforehand can significantly enhance your borrowing prospects. Family Financial Loan Services offers a range of loan products and personalized support to help you achieve your financial goals. This guide will provide practical steps to improve your credit score before applying for a loan. 1. Understand Your Credit Score Obtain Your Credit Report Start by obtaining a free copy of your credit report from each of the three major credit bureaus: Equifax, Experian, and TransUnion. You can access these reports once a year for free through AnnualCreditReport.com. Review Your Credit Report Carefully review your credit reports for any errors or discrepancies. Common errors include incorrect personal information, inaccurate account statuses, and erroneous negative marks. Identify Areas for Improvement Identify the factors negatively impacting your credit score. These may include high credit card balances, late payments, or a high number of recent credit inquiries. 2. Dispute Errors on Your Credit Report File a Dispute If you find any inaccuracies on your credit report, file a dispute with the relevant credit bureau. Provide supporting documentation to substantiate your claim. Follow Up Monitor the status of your dispute and ensure that the errors are corrected. This process can take up to 30 days, but it’s essential for maintaining an accurate credit report. 3. Pay Down Existing Debts Prioritize High-Interest Debts Focus on paying down high-interest debts first, such as credit card balances. Reducing these balances can significantly improve your credit utilization ratio, which accounts for a substantial portion of your credit score. Make Extra Payments If possible, make extra payments toward your debts. Even small additional payments can help reduce your balances faster and improve your credit score. Consolidate Debts Consider consolidating high-interest debts into a single loan with a lower interest rate. This can simplify your payments and potentially lower your overall interest costs. 4. Make Timely Payments Set Up Payment Reminders Set up payment reminders through your bank or use financial apps to ensure you never miss a due date. Consistently making on-time payments is crucial for maintaining a good credit score. Automate Payments Consider setting up automatic payments for your bills and loans. This ensures that your payments are made on time, reducing the risk of late payments. Address Late Payments If you have any late payments, bring those accounts current as soon as possible. The longer an account is delinquent, the more it can damage your credit score. 5. Reduce Credit Utilization Lower Your Credit Card Balances Aim to keep your credit card balances below 30% of your credit limit. High credit utilization can negatively impact your credit score, so paying down your balances can lead to a quick improvement. Request Credit Limit Increases Requesting a credit limit increase can help improve your credit utilization ratio. However, avoid increasing your spending as a result of the higher limit. Avoid Closing Accounts Keep your credit card accounts open, even if you’re not using them. Closing accounts can reduce your available credit and negatively impact your credit utilization ratio. 6. Limit New Credit Inquiries Avoid Applying for New Credit Refrain from applying for new credit cards or loans in the months leading up to your loan application. Each hard inquiry can slightly lower your credit score. Plan Credit Applications If you need to apply for credit, do so within a short period. Multiple inquiries for the same type of credit within a short timeframe are often treated as a single inquiry for scoring purposes. 7. Diversify Your Credit Mix Maintain a Healthy Credit Mix Having a mix of different types of credit accounts (e.g., credit cards, installment loans, mortgages) can positively impact your credit score. However, only take on new credit if it makes financial sense. Pay Off Small Balances If you have small balances on several credit cards, pay them off. Keeping multiple accounts with low balances can improve your credit score. 8. Build a Positive Payment History Keep Old Accounts Open Older credit accounts with positive payment histories can boost your credit score. Keep these accounts open and active to maintain a long credit history. Use Credit Responsibly Use your credit cards regularly but responsibly. Small, manageable purchases that you can pay off each month help build a positive payment history. Monitor Your Credit Regularly Regularly monitoring your credit report can help you catch and address issues quickly. Many financial institutions offer free credit monitoring services to help you stay informed about your credit status. 9. Seek Professional Help if Needed Credit Counseling If you’re struggling to manage your debts and improve your credit score, consider seeking help from a credit counseling agency. These organizations can provide personalized advice and assistance. Financial Advisors Consulting with a financial advisor can help you create a plan to improve your credit score and overall financial health. Family Financial Loan Services can connect you with resources to support your financial goals. Conclusion Improving your credit score before applying for a loan in Batesville, Mississippi, can significantly enhance your chances of securing favorable terms and lower interest rates. By understanding your credit score, disputing errors, paying down debts, making timely payments, reducing credit utilization, limiting new credit inquiries, diversifying your credit mix, and building a positive payment history, you can achieve a better credit score. Family Financial Loan Services offers a range of loan products and personalized support to help you navigate the borrowing process. Contact them today to learn more about their loan options and how they can assist you in improving your credit score. With the right approach and resources, you can achieve your financial goals and enjoy the benefits of a strong credit profile.

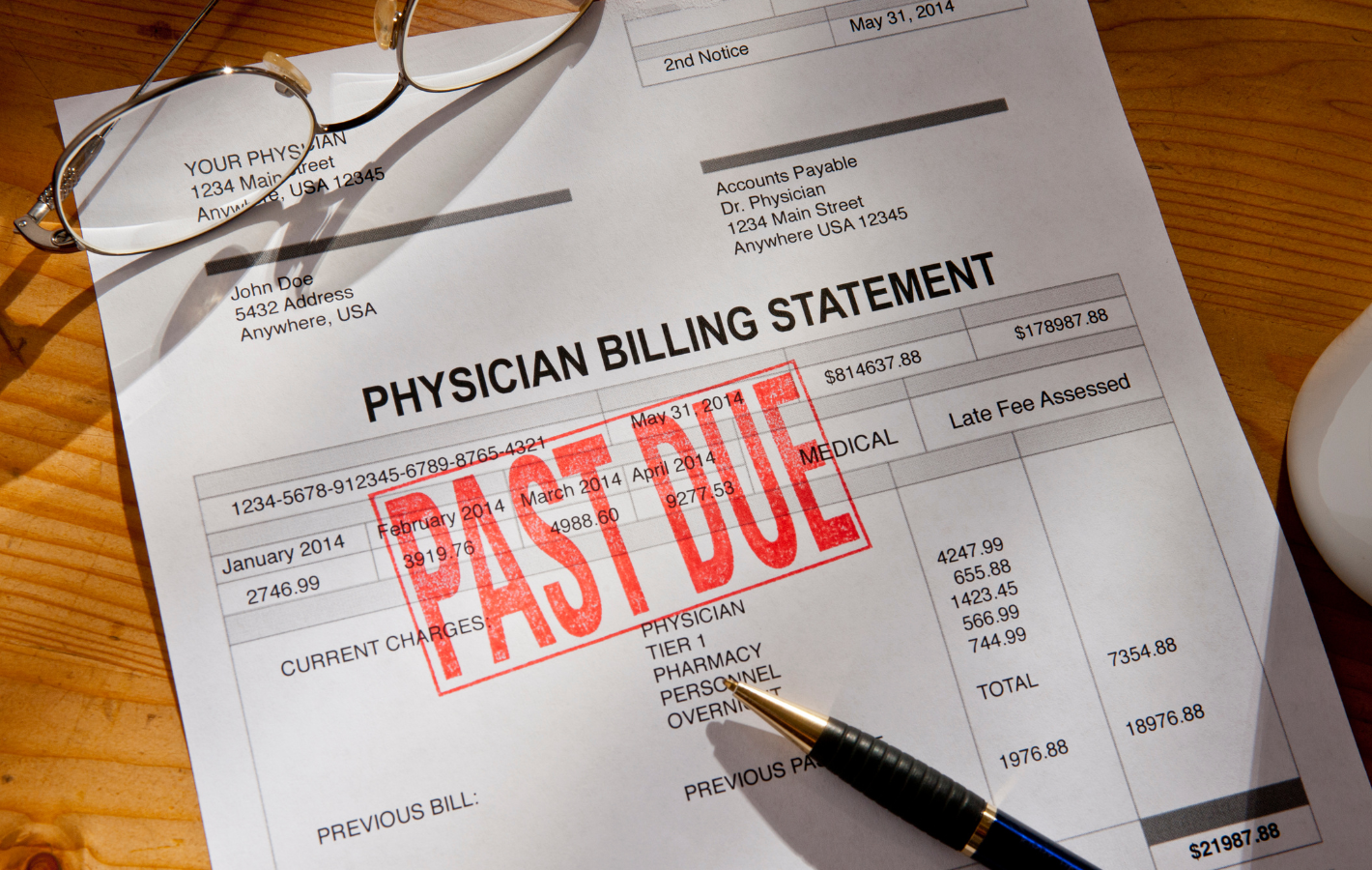

Unexpected medical expenses can place a significant financial burden on individuals and families. For residents of Batesville, Mississippi, using a personal loan to cover medical costs can provide much-needed relief and flexibility. Family Financial Loan Services offers a range of personal loan products designed to help you manage healthcare expenses effectively. This guide will provide tips on how to use a personal loan to cover medical expenses and ensure you make informed financial decisions. 1. Assess Your Medical Expenses Identify Your Medical Needs Determine the specific medical expenses you need to cover. These may include: Surgical Procedures: Costs associated with surgeries, including hospital stays and surgeon fees. Medical Treatments: Ongoing treatments for chronic conditions, such as chemotherapy or dialysis. Dental Work: Procedures such as braces, root canals, or dental implants. Vision Care: Costs for glasses, contact lenses, or corrective eye surgeries. Prescriptions: Expenses for medications not fully covered by insurance. Therapies: Physical therapy, occupational therapy, or mental health counseling. Calculate the Total Cost Sum up all your medical expenses to determine the total amount you need to borrow. Include any out-of-pocket costs, deductibles, and co-pays not covered by insurance. Review Your Insurance Coverage Before applying for a loan, review your health insurance policy to understand what is covered and what you will need to pay out-of-pocket. This will help you avoid borrowing more than necessary. 2. Explore Loan Options Types of Loans Available Different types of loans can be used to cover medical expenses. Understanding your options will help you choose the best loan for your needs: Personal Loans: Unsecured loans that can be used for various purposes, including medical expenses. Medical Loans: Specialized loans designed specifically for healthcare costs. Credit Cards: While not a loan, using a credit card for some medical expenses might be beneficial, especially if you have a card with low interest rates or a promotional period. Compare Loan Terms Research and compare loan terms from multiple lenders, including interest rates, repayment terms, and fees. Family Financial Loan Services in Batesville, MS, offers competitive rates and flexible terms for personal loans. Use Online Tools Utilize online loan calculators to estimate monthly payments, total interest, and overall loan costs based on different loan terms and interest rates. This will help you understand the financial implications of each loan option. 3. Check Your Credit Score Importance of Credit Score Your credit score significantly impacts your loan eligibility and the interest rate you’ll be offered. Higher credit scores generally lead to lower interest rates and better loan terms. Obtain Your Credit Report Get a free copy of your credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) through AnnualCreditReport.com. Review your reports for accuracy and address any discrepancies. Improve Your Credit Score If your credit score is less than ideal, take steps to improve it before applying for a loan: Pay Down Existing Debts: Reducing your debt can improve your credit score and lower your debt-to-income ratio. Make Timely Payments: Consistently making on-time payments for your bills and existing loans can gradually improve your credit score. Avoid New Credit Inquiries: Multiple credit inquiries within a short period can negatively impact your credit score. 4. Get Pre-Approved Benefits of Pre-Approval Getting pre-approved for a loan provides a clear idea of how much you can borrow and the interest rate you’ll be offered. It also demonstrates to medical providers that you’re a serious payer with secure financing. Pre-Approval Process To get pre-approved, you’ll need to provide documentation such as proof of income, employment verification, and credit history. Family Financial Loan Services can guide you through the pre-approval process, ensuring you have all the necessary paperwork and information. 5. Apply for the Loan Complete the Application Fill out the loan application accurately and completely. Provide all requested information and double-check for errors. Incomplete or inaccurate applications can delay the approval process or result in denial. Submit Supporting Documents Submit all required supporting documents along with your application. Ensure that all documents are up-to-date and legible. Review the Loan Agreement Carefully review the loan agreement before signing. Ensure you understand all terms and conditions, including the interest rate, repayment schedule, fees, and any penalties for late payments or early repayment. 6. Manage Your Loan and Medical Expenses Set Up Automatic Payments Consider setting up automatic payments from your bank account to ensure you never miss a due date. This can help you avoid late fees and maintain a positive payment history. Track Your Spending Keep track of your spending to ensure you stay within your budget and can comfortably make your loan payments. Use financial tools and apps to monitor your expenses and manage your budget effectively. Build an Emergency Fund Having an emergency fund can provide a financial cushion in case of unexpected expenses. Aim to save at least three to six months’ worth of living expenses to protect yourself against financial setbacks. Communicate with Your Lender If you encounter any financial difficulties or have questions about your loan, communicate with your lender as soon as possible. Family Financial Loan Services is committed to supporting borrowers and may offer solutions such as payment extensions or modified repayment plans. 7. Explore Additional Resources Medical Payment Plans Many medical providers offer payment plans that allow you to spread out the cost of your medical expenses over time. Ask your healthcare provider if they have any financing options available. Health Savings Accounts (HSAs) If you have a Health Savings Account (HSA), you can use the funds to pay for qualified medical expenses. HSAs offer tax advantages, as contributions are tax-deductible, and withdrawals for medical expenses are tax-free. Nonprofit Organizations Some nonprofit organizations provide financial assistance for medical expenses. Research local and national organizations that may offer grants or aid for your specific medical needs. Conclusion Using a personal loan to cover medical expenses in Batesville, Mississippi, can provide financial relief and flexibility during a challenging time. By assessing your medical expenses, exploring loan options, checking your credit score, getting pre-approved, and managing your loan responsibly, you can make informed financial decisions and ensure you receive the necessary medical care. Family Financial Loan Services offers a variety of loan products and personalized support to help you navigate the borrowing process. Contact them today to learn more about their loan options and how they can assist you in financing your medical expenses. With the right approach and resources, you can manage your healthcare costs effectively and maintain your financial stability.

Taking a dream vacation can be a once-in-a-lifetime experience, but it often comes with a significant price tag. If you’re looking to finance your trip, a personal loan can provide the funds you need without straining your budget. For residents of Batesville, Mississippi, Family Financial Loan Services offers various loan products to help make your dream vacation a reality. This guide will walk you through the process of financing your dream vacation with a loan, from planning your budget to managing your repayments. 1. Plan Your Vacation Budget Define Your Dream Vacation Identify the destination, duration, and activities for your dream vacation. This will help you create a detailed budget and understand the total cost. Estimate Costs Consider all possible expenses, including: Flights: Airfare to and from your destination. Accommodation: Hotels, resorts, or vacation rentals. Transportation: Car rentals, public transportation, or rideshares. Food and Dining: Meals, snacks, and beverages. Activities and Excursions: Tours, attractions, and entertainment. Travel Insurance: Coverage for medical emergencies, trip cancellations, and lost luggage. Miscellaneous Expenses: Souvenirs, tips, and other incidentals. Create a Detailed Budget Sum up all estimated costs to determine the total amount you need for your vacation. Break down the budget into categories to get a clear picture of your expenses. 2. Explore Loan Options Types of Loans Available Different types of loans can be used to finance your vacation. Understanding your options will help you choose the best loan for your needs: Personal Loans: Unsecured loans that can be used for various purposes, including travel. Travel Loans: Specialized loans designed specifically for financing vacations. Credit Cards: While not a loan, using a credit card for some expenses might be beneficial, especially if you earn travel rewards or cashback. Compare Loan Terms Research and compare loan terms from multiple lenders, including interest rates, repayment terms, and fees. Family Financial Loan Services in Batesville, MS, offers competitive rates and flexible terms for personal loans. Use Online Tools Utilize online loan calculators to estimate monthly payments, total interest, and overall loan costs based on different loan terms and interest rates. This will help you understand the financial implications of each loan option. 3. Check Your Credit Score Importance of Credit Score Your credit score significantly impacts your loan eligibility and the interest rate you’ll be offered. Higher credit scores generally lead to lower interest rates and better loan terms. Obtain Your Credit Report Get a free copy of your credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) through AnnualCreditReport.com. Review your reports for accuracy and address any discrepancies. Improve Your Credit Score If your credit score is less than ideal, take steps to improve it before applying for a loan: Pay Down Existing Debts: Reducing your debt can improve your credit score and lower your debt-to-income ratio. Make Timely Payments: Consistently making on-time payments for your bills and existing loans can gradually improve your credit score. Avoid New Credit Inquiries: Multiple credit inquiries within a short period can negatively impact your credit score. 4. Get Pre-Approved Benefits of Pre-Approval Getting pre-approved for a loan provides a clear idea of how much you can borrow and the interest rate you’ll be offered. It also demonstrates to travel agents or vendors that you’re a serious buyer with secure financing. Pre-Approval Process To get pre-approved, you’ll need to provide documentation such as proof of income, employment verification, and credit history. Family Financial Loan Services can guide you through the pre-approval process, ensuring you have all the necessary paperwork and information. 5. Apply for the Loan Complete the Application Fill out the loan application accurately and completely. Provide all requested information and double-check for errors. Incomplete or inaccurate applications can delay the approval process or result in denial. Submit Supporting Documents Submit all required supporting documents along with your application. Ensure that all documents are up-to-date and legible. Review the Loan Agreement Carefully review the loan agreement before signing. Ensure you understand all terms and conditions, including the interest rate, repayment schedule, fees, and any penalties for late payments or early repayment. 6. Manage Your Loan and Vacation Expenses Set Up Automatic Payments Consider setting up automatic payments from your bank account to ensure you never miss a due date. This can help you avoid late fees and maintain a positive payment history. Track Your Spending Keep track of your spending to ensure you stay within your budget and can comfortably make your loan payments. Use financial tools and apps to monitor your expenses and manage your budget effectively. Build an Emergency Fund Having an emergency fund can provide a financial cushion in case of unexpected expenses during your vacation. Aim to save at least three to six months’ worth of living expenses to protect yourself against financial setbacks. Communicate with Your Lender If you encounter any financial difficulties or have questions about your loan, communicate with your lender as soon as possible. Family Financial Loan Services is committed to supporting borrowers and may offer solutions such as payment extensions or modified repayment plans. 7. Enjoy Your Vacation Responsibly Stick to Your Budget Adhering to your budget is crucial for the successful completion of your vacation without incurring additional debt. Monitor your expenses closely and avoid unnecessary spending. Use Credit Wisely If you use a credit card during your trip, ensure you can pay off the balance promptly to avoid high-interest charges. Take advantage of any travel rewards or cashback offers that can help offset your vacation costs. Plan for the Future After returning from your vacation, review your financial situation and adjust your budget as needed. Reflect on your spending habits and plan for future vacations with the knowledge and experience gained. Conclusion Financing your dream vacation with a loan in Batesville, Mississippi, requires careful planning and strategic decision-making. By defining your vacation budget, exploring loan options, checking your credit score, getting pre-approved, and managing your loan responsibly, you can make informed choices and enjoy your trip without financial stress. Family Financial Loan Services offers a variety of loan products and personalized support to help you navigate the borrowing process. Contact them today to learn more about their loan options and how they can assist you in financing your dream vacation. With the right approach and resources, you can make your dream vacation a reality and create lasting memories without compromising your financial stability.