Blog Layout

What Can I Use a Personal Loan For?

June 18, 2024

Personal loans are more ubiquitous and accessible than ever. According to TransUnion, the number of people with personal loans has gone from 15 million to over 20 million in recent years. It’s not hard to understand why they've become so popular; apart from being accessible, those loans can also be used for varied applications. Let's review them below.

Buying Appliances

Many homeowners are looking to upgrade their spaces; however, the improvements they want may be pricier than they can afford at the moment. Until they get to a point where they can afford those upgrades, they may settle for smaller purchases that can still make a household better. New appliances that feature the latest technology fall into that category. Using your loan to purchase a new refrigerator, television, or air conditioner is worth considering if your home feels outdated.

Upgrading Your Home

Once your finances are at the point where you can afford to take out a larger personal loan, you can start pursuing home upgrades. The best ones address existing problems in your household. For instance, you can secure a larger loan and pay for a roof replacement if leaks have become a major issue.

Applying for a larger loan still makes sense even if your home isn’t in dire need of repair. Certain upgrades can improve your quality of life and make your home comfortable. Revamped floor layouts, new lighting, and fresh paint jobs qualify as such improvements.

Securing Transportation

Aside from homes, another asset many individuals need to get to work and other necessities is a quality vehicle. In some cases, using a loan to buy a new car is more of a necessity than a luxury. If your car is no longer fit for regular usage, replacing it is your only option. Paying for auto repairs using a loan is also quite common.

Vacationing

Everyone deserves a holiday. If you’re going on a family vacation, you might as well splurge to make it the best holiday you’ve ever taken. Apply for a loan and use the money to bring your dream vacation to life.

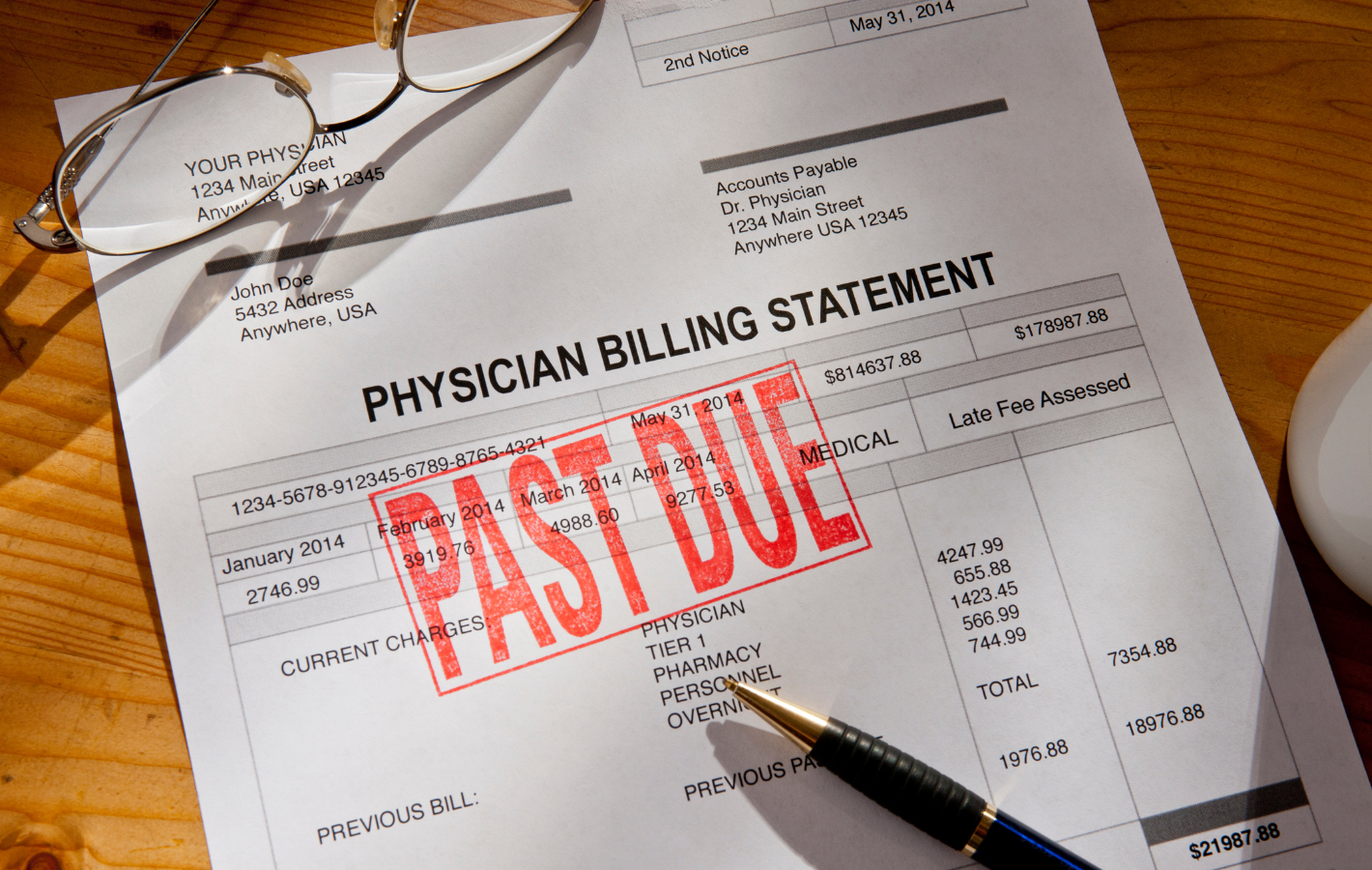

Covering Emergencies

Personal loans aren't just for enjoyable expenses; you may also need them to cover medical emergencies. Ensure your spouse or children receive high-quality medical care by taking out a loan.

The versatility of a personal loan is one of its main selling points. As long as you meet the requirements, you can use your loan virtually any way you see fit. Get in touch with our team at FAMILY FINANCIAL SERVICES, INCORPORATED today to discuss the specifics of your loan!

Share

Tweet

Share

Mail

March 12, 2025

When applying for a loan, one of the most important decisions you'll make is choosing between a fixed or variable interest rate. Each option has its own set of advantages and disadvantages, and understanding these can help you make an informed choice that best suits your financial situation and goals. For residents of Batesville, Mississippi, Family Financial Loan Services offers a variety of loan products with both fixed and variable interest rates. In this blog, we'll explore the differences between fixed and variable interest rates, their benefits and drawbacks, and how to decide which option is right for you. What is a Fixed Interest Rate? Definition A fixed interest rate remains constant throughout the life of the loan. This means that your monthly payments will stay the same, regardless of changes in the broader interest rate environment. Benefits of Fixed Interest Rates Predictable Payments Fixed interest rates provide stability and predictability in your monthly payments. This makes budgeting easier, as you’ll know exactly how much you need to pay each month. Protection Against Rate Increases With a fixed interest rate, you are protected from potential increases in interest rates. This can be particularly beneficial in a rising interest rate environment, as your loan payments will remain unaffected. Long-Term Planning Fixed interest rates are ideal for long-term loans, such as mortgages or long-term personal loans, where stability and predictability are crucial for financial planning. Drawbacks of Fixed Interest Rates Higher Initial Rates Fixed interest rates are often higher than variable rates at the outset. This is because lenders assume the risk of interest rate increases over the life of the loan. Limited Flexibility If interest rates fall, you won’t benefit from lower rates unless you refinance your loan, which can involve additional costs and paperwork. What is a Variable Interest Rate? Definition A variable interest rate, also known as an adjustable rate, can change periodically based on changes in a benchmark interest rate, such as the prime rate or LIBOR. This means your monthly payments can fluctuate over time. Benefits of Variable Interest Rates Lower Initial Rates Variable interest rates are often lower than fixed rates at the beginning of the loan term. This can result in lower initial monthly payments and reduced overall interest costs, at least in the short term. Potential for Decreased Rates If interest rates decrease, your variable rate could also decrease, leading to lower monthly payments without the need for refinancing. Short-Term Savings For short-term loans or for borrowers planning to pay off their loans quickly, variable rates can offer significant interest savings compared to fixed rates. Drawbacks of Variable Interest Rates Payment Uncertainty With a variable interest rate, your monthly payments can increase if interest rates rise. This unpredictability can make budgeting more challenging and may lead to financial strain if rates increase significantly. Long-Term Risk Over the long term, variable rates can potentially become more expensive than fixed rates, especially in a rising interest rate environment. This risk must be carefully considered, particularly for long-term loans. How to Choose Between Fixed and Variable Interest Rates Assess Your Financial Situation Stability of Income If you have a stable and predictable income, a fixed interest rate may provide the financial stability you need. Conversely, if your income fluctuates or you expect it to increase in the future, a variable rate could offer initial savings with manageable risk. Loan Term For long-term loans, such as mortgages, a fixed interest rate can provide the stability needed for long-term financial planning. For short-term loans or if you plan to pay off the loan quickly, a variable rate might offer lower costs. Evaluate Market Conditions Interest Rate Trends Consider current and projected interest rate trends. If interest rates are expected to rise, a fixed rate may be more advantageous. If rates are stable or declining, a variable rate could offer savings. Economic Outlook The broader economic outlook can impact interest rate trends. Economic growth, inflation, and central bank policies are key factors to consider when evaluating the potential movement of interest rates. Consider Your Risk Tolerance Comfort with Fluctuations Assess your comfort level with fluctuating monthly payments. If the possibility of increased payments would cause significant stress, a fixed rate may be the better choice. If you can handle some variability in your payments, a variable rate could offer savings. Financial Goals Long-Term vs. Short-Term Goals Align your choice with your financial goals. If you’re focused on long-term stability and predictability, a fixed rate aligns well with these goals. If you’re looking to minimize costs in the short term and can manage potential payment changes, a variable rate could be beneficial. Examples of Fixed and Variable Rate Loans Fixed Rate Loan Example Mortgage A 30-year fixed-rate mortgage offers stable monthly payments over the life of the loan. This predictability can help homeowners budget effectively and plan for the future without worrying about interest rate increases. Variable Rate Loan Example HELOC A Home Equity Line of Credit (HELOC) typically comes with a variable interest rate. Borrowers can benefit from lower initial rates and the flexibility to draw funds as needed, with the understanding that rates may fluctuate. Conclusion Choosing between a fixed and variable interest rate is a crucial decision that depends on your financial situation, goals, and risk tolerance. Fixed rates offer stability and predictability, making them ideal for long-term loans and borrowers seeking financial certainty. Variable rates can provide short-term savings and flexibility but come with the risk of fluctuating payments. Family Financial Loan Services in Batesville, Mississippi, offers a range of loan products with both fixed and variable interest rates to meet your needs. Their team of financial experts can help you assess your situation, understand the options, and make an informed decision. Contact Family Financial Loan Services today to learn more about their loan products and find the best interest rate option for your financial goals.

February 20, 2025

Debt consolidation can be an effective strategy for managing multiple debts and reducing your overall financial burden. For residents of Batesville, Mississippi, using a personal loan for debt consolidation can simplify your finances, lower your interest rates, and help you pay off debt faster. Family Financial Loan Services offers a range of personal loan products designed to meet your debt consolidation needs. This guide will explore how to use a personal loan for debt consolidation and provide tips for managing your debt effectively. Understanding Debt Consolidation What is Debt Consolidation? Debt consolidation involves combining multiple debts into a single loan with a lower interest rate. This process simplifies your debt management by reducing the number of monthly payments you need to make and can potentially save you money on interest over time. Benefits of Debt Consolidation Simplified Finances: Consolidate multiple debts into one monthly payment. Lower Interest Rates: Secure a lower interest rate than your current debts, reducing overall interest costs. Fixed Repayment Schedule: Enjoy a predictable repayment plan with fixed monthly payments. Improved Credit Score: Making timely payments on your consolidation loan can improve your credit score over time. Steps to Use a Personal Loan for Debt Consolidation 1. Assess Your Debt Situation List Your Debts Start by listing all your current debts, including credit cards, personal loans, medical bills, and any other outstanding balances. Note the interest rates, minimum monthly payments, and remaining balances for each debt. Calculate Total Debt Add up the total amount of debt you need to consolidate. This will help you determine the loan amount you need to apply for. Evaluate Interest Rates Compare the interest rates on your existing debts with the potential interest rate on a personal loan. This will help you understand the potential savings from consolidating your debt. 2. Check Your Credit Score Obtain Your Credit Report Your credit score plays a significant role in determining your eligibility for a personal loan and the interest rate you’ll be offered. Obtain a free copy of your credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) through AnnualCreditReport.com. Review Your Credit Report Review your credit report for accuracy and identify any errors or discrepancies. Dispute any inaccuracies that could negatively impact your credit score. Improve Your Credit Score If your credit score is lower than desired, take steps to improve it before applying for a personal loan. This includes paying down existing debts, making timely payments, and avoiding new credit inquiries. 3. Research Lenders Compare Loan Options Research and compare personal loan options from multiple lenders, including banks, credit unions, and online lenders. Family Financial Loan Services in Batesville, MS, offers competitive rates and personalized service for debt consolidation loans. Read Customer Reviews Look for customer reviews and testimonials to gauge the lender’s reputation and customer service. Choose a lender with positive feedback from other borrowers. 4. Apply for a Personal Loan Gather Required Documentation Prepare the necessary documentation for your loan application, such as proof of income, identification, and details about your existing debts. Having these documents ready can expedite the approval process. Complete the Loan Application Fill out the loan application accurately and completely. Provide all requested information and double-check for errors. Incomplete or inaccurate applications can delay the approval process or result in denial. Submit Supporting Documents Submit all required supporting documents along with your application. Ensure that all documents are up-to-date and legible. 5. Use the Loan to Pay Off Debts Receive Loan Funds Once your loan is approved, the lender will disburse the funds to your bank account. The time it takes to receive the funds can vary, but it’s typically within a few business days. Pay Off Existing Debts Use the loan funds to pay off your existing debts in full. Ensure you pay off each debt completely to avoid any remaining balances or additional interest charges. Confirm Debt Payoff After paying off your debts, confirm with each creditor that your balances are zero and your accounts are closed (if applicable). Keep records of all payments and confirmations for your records. 6. Manage Your Consolidation Loan Create a Repayment Plan Create a detailed repayment plan for your consolidation loan. Include the loan amount, interest rate, repayment term, and monthly payment amount. Ensure the payments fit within your budget without causing financial strain. Set Up Automatic Payments Consider setting up automatic payments from your bank account to ensure you never miss a due date. This can help you avoid late fees and maintain a positive payment history. Monitor Your Loan Keep track of your loan balance, payment schedule, and interest rate. Regularly review your loan statements to ensure all payments are correctly applied. 7. Avoid Accumulating New Debt Stick to Your Budget Maintain a budget that prioritizes your loan payments and essential living expenses. Avoid unnecessary spending and focus on paying off your consolidation loan. Build an Emergency Fund Having an emergency fund can provide a financial cushion in case of unexpected expenses. Aim to save at least three to six months’ worth of living expenses to avoid relying on credit cards or loans in emergencies. Use Credit Responsibly Use credit cards and other forms of credit responsibly. Avoid carrying high balances and make timely payments to maintain a good credit score. Conclusion Using a personal loan for debt consolidation can be an effective strategy for managing multiple debts and reducing your overall financial burden. By assessing your debt situation, checking your credit score, researching lenders, and following a structured repayment plan, you can successfully consolidate your debt and achieve financial stability. Family Financial Loan Services in Batesville, Mississippi, offers a variety of personal loan products and personalized support to help you navigate the debt consolidation process. Contact them today to learn more about their loan options and how they can assist you in achieving your financial goals. With the right approach and resources, you can take control of your debt and enjoy the benefits of simplified finances and lower interest costs.

January 30, 2025

Applying for a loan for the first time can be both exciting and overwhelming. Whether you need funds for a personal project, an emergency expense, or starting a new venture, understanding the loan application process and being well-prepared can increase your chances of approval and ensure you secure the best possible terms. For residents of Batesville, Mississippi, Family Financial Loan Services offers a range of loan options to meet diverse needs. In this blog, we’ll provide valuable tips for first-time loan applicants to help you navigate the process with confidence. 1. Understand Your Loan Options Types of Loans Available Before applying for a loan, it’s essential to understand the different types of loans available and which one best suits your needs: Personal Loans: Unsecured loans that can be used for various purposes, such as debt consolidation, home improvement, or medical expenses. Cash Loans: Short-term loans designed for immediate financial relief, often repaid by your next paycheck. Same-Day Loans: Quick-access loans ideal for urgent financial needs, with approval and funding typically within hours. Payday Loans: Small, short-term loans intended to cover expenses until your next payday. Auto Loans: Secured loans specifically for purchasing a vehicle. Business Loans: Loans designed to support business needs, such as expansion, equipment purchase, or managing cash flow. Choosing the Right Loan Identify your financial needs and goals to choose the right loan type. Consider the loan amount, repayment term, interest rate, and any specific requirements related to the loan type. 2. Check Your Credit Score Importance of Credit Score Your credit score is a critical factor in determining your loan eligibility and the interest rate you’ll be offered. A higher credit score can lead to better loan terms and lower interest rates. How to Check Your Credit Score You can obtain a free credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) once a year through AnnualCreditReport.com. Review your credit report for accuracy and identify any errors or discrepancies. Improving Your Credit Score If your credit score is less than ideal, take steps to improve it before applying for a loan: Pay Down Existing Debts: Reducing your overall debt can improve your credit score and lower your debt-to-income ratio. Make Timely Payments: Consistently making on-time payments for your bills and existing debts can gradually improve your credit score. Avoid Opening New Credit Accounts: Multiple credit inquiries within a short period can negatively impact your credit score. 3. Gather Necessary Documentation Commonly Required Documents Having the required documentation ready can streamline the loan application process. Commonly required documents include: Identification: Government-issued ID, such as a driver’s license or passport. Proof of Income: Recent pay stubs, tax returns, or bank statements to confirm your income. Employment Information: Details about your current employment, such as an employer’s name and contact information. Bank Account Information: Your bank account details for fund disbursement. Organizing Your Documents Keep your documents organized and easily accessible. This will help you complete your application more efficiently and respond quickly to any additional requests from the lender. 4. Create a Detailed Budget Assess Your Financial Situation Creating a detailed budget helps you understand your financial situation and determine how much you can afford to borrow. List your monthly income and expenses, including rent/mortgage, utilities, groceries, transportation, and other regular payments. Calculate Loan Affordability Determine the loan amount you need and calculate the monthly payments based on the interest rate and repayment term. Ensure the payments fit within your budget without causing financial strain. Plan for Repayment Having a repayment plan in place ensures you can manage your loan responsibly. Consider setting up automatic payments to avoid missing due dates and incurring late fees. 5. Compare Lenders and Loan Offers Researching Lenders Not all lenders offer the same terms and conditions. Research multiple lenders to find the best loan options. Look at interest rates, repayment terms, fees, and customer reviews. Comparing Loan Offers Use online comparison tools to compare loan offers from different lenders. Pay attention to the annual percentage rate (APR), which includes the interest rate and any fees, to get a complete picture of the loan’s cost. Choosing Family Financial Loan Services Family Financial Loan Services in Batesville, MS, offers competitive rates, personalized service, and a straightforward application process. Consider their loan products and reach out for a consultation to understand how they can meet your needs. 6. Submit a Complete and Accurate Application Providing Accurate Information Ensure all the information you provide on your loan application is accurate and complete. Inaccurate or incomplete information can delay the approval process or result in a loan denial. Double-Check Your Application Review your application carefully before submitting it. Double-check all details, such as your personal information, income, and employment details, to avoid any mistakes. 7. Be Prepared for the Approval Process Understanding the Process Once you submit your application, the lender will review your information, verify your documentation, and assess your creditworthiness. This process may involve underwriting, where the lender evaluates your financial situation in detail. Communicating with the Lender Stay in touch with the lender during the approval process. Respond promptly to any requests for additional information or clarification. Clear communication can help expedite the process and increase your chances of approval. 8. Review the Loan Agreement Carefully Understanding Loan Terms If your loan application is approved, carefully review the loan agreement. Ensure you understand all the terms and conditions, including the interest rate, repayment schedule, fees, and any penalties for late payments or early repayment. Asking Questions If you have any questions or concerns about the loan terms, don’t hesitate to ask the lender for clarification. It’s essential to fully understand your obligations before signing the agreement. Signing the Agreement Once you’re satisfied with the loan terms, sign the agreement to accept the loan. Keep a copy of the agreement for your records. 9. Manage Your Loan Responsibly Making Timely Payments Ensure you make all loan payments on time to avoid late fees and damage to your credit score. Set up automatic payments or reminders to help you stay on track. Monitoring Your Loan Keep track of your loan balance, payment schedule, and interest rate. Regularly review your loan statements to ensure all payments are correctly applied. Seeking Help if Needed If you encounter financial difficulties and have trouble making your loan payments, contact your lender immediately. Family Financial Loan Services is committed to helping borrowers and may offer solutions such as payment extensions or modified repayment plans. Conclusion Applying for a loan for the first time in Batesville, Mississippi, can be a smooth and successful process with the right preparation and understanding. By assessing your financial needs, checking your credit score, gathering necessary documentation, creating a budget, comparing lenders, and managing your loan responsibly, you can secure the funding you need while maintaining your financial health. Family Financial Loan Services is here to support you every step of the way, offering personalized service and competitive loan products to help you achieve your financial goals. Contact them today to learn more about their loan options and how they can assist you in your loan application journey.

January 2, 2025

Inflation is a critical economic factor that influences various aspects of personal finance, including loan rates. For residents of Batesville, Mississippi, understanding how inflation impacts loan rates can help you make informed borrowing decisions and manage your finances more effectively. Family Financial Loan Services provides a range of loan products with competitive rates, and staying informed about economic trends can help you choose the best options. This blog will explore the relationship between inflation and loan rates, its effects on borrowers, and strategies to navigate these changes. What is Inflation? Definition Inflation is the rate at which the general level of prices for goods and services rises, eroding purchasing power. It is typically measured by the Consumer Price Index (CPI) or the Producer Price Index (PPI). Causes of Inflation Demand-Pull Inflation: Occurs when demand for goods and services exceeds supply, driving up prices. Cost-Push Inflation: Results from increased production costs, such as wages and raw materials, leading to higher prices. Built-In Inflation: Stems from the expectation of future inflation, leading to higher wages and prices. How Inflation Affects Loan Rates Central Bank Policies Central banks, such as the Federal Reserve, use monetary policy to control inflation. When inflation rises, central banks may increase interest rates to cool down the economy. Higher interest rates make borrowing more expensive, which can help reduce spending and slow inflation. Interest Rate Adjustments When inflation is high, lenders often raise loan rates to compensate for the decreased purchasing power of future loan repayments. Conversely, during periods of low inflation, loan rates tend to be lower. Fixed vs. Variable Rates Fixed Rates: Loans with fixed interest rates remain unchanged throughout the loan term, providing stability for borrowers. However, if inflation rises significantly, new fixed-rate loans may have higher rates. Variable Rates: Loans with variable interest rates fluctuate based on market conditions. During inflationary periods, variable rates can increase, leading to higher monthly payments for borrowers. Effects of Inflation on Borrowers Higher Borrowing Costs As inflation drives up loan rates, the cost of borrowing increases. This means higher monthly payments for new loans and, potentially, for existing variable-rate loans. Borrowers may need to adjust their budgets to accommodate these higher costs. Reduced Purchasing Power Inflation erodes the value of money over time, reducing purchasing power. For borrowers, this means that the real value of loan repayments decreases, which can be beneficial for fixed-rate loans but challenging for variable-rate loans with increasing payments. Impact on Savings and Investments High inflation can reduce the real return on savings and investments, as the purchasing power of interest earned diminishes. Borrowers need to consider this when planning their finances and choosing loan products. Strategies to Navigate Inflation's Impact on Loans Choose Fixed-Rate Loans Opting for fixed-rate loans can provide stability and predictability in your monthly payments, protecting you from potential interest rate increases during inflationary periods. While initial rates may be higher than variable rates, the certainty can be worth the trade-off. Refinance Existing Loans If you have existing variable-rate loans, consider refinancing them into fixed-rate loans to lock in current rates before they rise further. This can help you manage your budget more effectively and avoid unexpected increases in payments. Build an Emergency Fund Having an emergency fund can provide a financial cushion during inflationary periods, helping you manage higher loan payments and other rising costs. Aim to save at least three to six months’ worth of living expenses. Budget for Higher Payments Prepare for potential increases in loan payments by adjusting your budget. Reduce discretionary spending and prioritize paying down high-interest debt to free up more funds for loan repayments. Monitor Economic Trends Stay informed about economic trends and central bank policies. Understanding the broader economic environment can help you anticipate changes in loan rates and make proactive financial decisions. Conclusion Inflation has a significant impact on loan rates, affecting the cost of borrowing and overall financial planning. For residents of Batesville, Mississippi, being aware of these effects and adopting strategies to mitigate them can help you manage your finances more effectively. Family Financial Loan Services offers a variety of loan products with both fixed and variable rates, providing options to suit different financial needs and preferences. By understanding the relationship between inflation and loan rates, you can make informed decisions and navigate the borrowing landscape with confidence. Contact Family Financial Loan Services today to learn more about their loan products and how they can help you achieve your financial goals in an inflationary environment.

December 19, 2024

Securing a loan is a significant financial commitment, and managing your loan repayments effectively is crucial to maintaining your financial health. For residents of Batesville, Mississippi, Family Financial Loan Services offers various loan products and personalized support to help you navigate the repayment process. This guide will provide practical tips on how to manage your loan repayments, ensuring you stay on track and avoid financial pitfalls. 1. Understand Your Loan Terms Review the Loan Agreement Before you start making repayments, thoroughly review your loan agreement. Ensure you understand the following: Interest Rate: Know whether your rate is fixed or variable. Repayment Schedule: Familiarize yourself with the due dates and frequency of your payments. Total Loan Amount: Be clear on the principal amount you borrowed. Fees and Penalties: Understand any fees for late payments or early repayment. Ask Questions If any terms are unclear, contact your lender for clarification. Family Financial Loan Services is available to answer any questions you might have about your loan terms. 2. Create a Repayment Plan Set Up a Budget Creating a budget is a crucial step in managing your loan repayments. Include all your sources of income and list your monthly expenses. Allocate funds for: Loan Repayments: Ensure you prioritize your loan repayments in your budget. Living Expenses: Include rent, utilities, groceries, and other essential expenses. Savings: Aim to save a portion of your income for emergencies and future goals. Calculate Monthly Payments Use your loan agreement to determine your monthly payment amount. Ensure your budget can accommodate these payments without causing financial strain. Automate Payments Set up automatic payments from your bank account to ensure you never miss a due date. This can help you avoid late fees and maintain a positive repayment history. 3. Track Your Repayments Keep Records Maintain detailed records of your loan repayments. This includes payment dates, amounts, and remaining balances. Keeping track of your repayments can help you monitor your progress and stay organized. Use Financial Tools Consider using financial tools and apps to help manage your loan repayments. Many apps can send reminders, track your spending, and help you stay on top of your budget. Regularly Review Statements Periodically review your loan statements to ensure all payments are correctly applied. If you notice any discrepancies, contact your lender immediately. 4. Make Extra Payments When Possible Benefits of Extra Payments Making extra payments towards your loan can reduce the total interest paid and shorten the loan term. Even small additional payments can make a significant difference over time. Strategies for Extra Payments Round Up Payments: Round up your monthly payment to the nearest hundred dollars. Bi-Weekly Payments: Consider making bi-weekly payments instead of monthly payments. This results in one extra payment each year. Use Windfalls: Apply any unexpected income, such as bonuses or tax refunds, towards your loan. 5. Communicate with Your Lender Stay in Contact Maintain open communication with your lender throughout the loan repayment period. Family Financial Loan Services is committed to supporting borrowers and can provide assistance if you encounter financial difficulties. Request Modifications If you’re struggling to make your payments, contact your lender to discuss possible modifications. This might include extending the loan term, adjusting the payment schedule, or temporarily reducing payments. Avoid Default Defaulting on your loan can have serious consequences, including damage to your credit score and legal action. If you’re at risk of defaulting, reach out to your lender immediately to explore your options. 6. Refinance if Necessary Benefits of Refinancing Refinancing your loan can help you secure a lower interest rate, reduce monthly payments, or adjust the loan term to better fit your financial situation. When to Consider Refinancing Improved Credit Score: If your credit score has improved since you took out the loan, you might qualify for better terms. Lower Interest Rates: If market interest rates have dropped, refinancing could save you money. Financial Hardship: If you’re experiencing financial difficulties, refinancing might provide relief by extending the loan term or reducing payments. How to Refinance Contact Family Financial Loan Services to discuss your refinancing options. They can guide you through the process and help you determine if refinancing is the right choice for your situation. 7. Plan for the Future Build an Emergency Fund Having an emergency fund can provide a financial cushion in case of unexpected expenses. Aim to save at least three to six months’ worth of living expenses to protect yourself against financial setbacks. Improve Financial Habits Adopt healthy financial habits to improve your overall financial health. This includes creating and sticking to a budget, avoiding unnecessary debt, and setting financial goals. Seek Financial Advice Consider consulting with a financial advisor for personalized guidance on managing your loan repayments and improving your financial situation. 8. Stay Informed Monitor Economic Trends Stay informed about economic trends that could impact interest rates and loan terms. Understanding the broader financial landscape can help you make informed decisions about your loan. Educate Yourself Take advantage of financial education resources to improve your understanding of loans and personal finance. Family Financial Loan Services offers educational materials and support to help you navigate the repayment process. Conclusion Managing your loan repayments effectively is essential for maintaining financial stability and achieving your financial goals. By understanding your loan terms, creating a repayment plan, tracking your payments, and communicating with your lender, you can stay on top of your loan and avoid financial pitfalls. Family Financial Loan Services in Batesville, Mississippi, provides a range of loan products and personalized support to help you manage your repayments successfully. Contact them today to learn more about their loan options and how they can assist you in achieving financial success. With the right approach and resources, you can manage your loan repayments with confidence and enjoy the benefits of financial stability and security.

November 28, 2024

Applying for a personal loan can be a straightforward process if you know what to expect and how to prepare. For residents of Batesville, Mississippi, Family Financial Loan Services offers a range of personal loan products to meet diverse financial needs. This guide will walk you through the steps to apply for a personal loan, helping you navigate the process with ease and confidence. Step 1: Assess Your Financial Situation Determine Your Loan Purpose Before applying for a personal loan, clearly define the purpose of the loan. Common reasons for taking out a personal loan include: Debt Consolidation: Combining multiple debts into a single loan with a lower interest rate. Home Improvements: Financing renovations or repairs. Medical Expenses: Covering unexpected medical bills. Major Purchases: Funding significant expenses such as appliances or electronics. Emergency Expenses: Managing unexpected financial emergencies. Calculate How Much You Need Determine the exact amount you need to borrow. Borrowing too much can lead to higher monthly payments and increased interest costs, while borrowing too little may not fully cover your expenses. Create a detailed budget that outlines your income, expenses, and the specific amount you need to borrow. Evaluate Your Ability to Repay Assess your current financial situation, including your income, expenses, and existing debts. Use this information to determine how much you can afford to repay each month without straining your budget. Step 2: Check Your Credit Score Obtain Your Credit Report Your credit score is a critical factor in determining your loan eligibility and the interest rate you’ll be offered. Obtain a free copy of your credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) through AnnualCreditReport.com. Review your reports for accuracy and address any discrepancies that may negatively impact your score. Improve Your Credit Score If your credit score is less than ideal, take steps to improve it before applying for a loan. This may include paying down existing debts, making timely payments, and avoiding new credit inquiries. Step 3: Research Lenders Compare Loan Options Research and compare personal loan options from multiple lenders. Consider factors such as interest rates, loan amounts, repayment terms, and fees. Family Financial Loan Services in Batesville, MS, offers competitive rates and personalized service, making them an excellent choice for your personal loan needs. Read Reviews Look for customer reviews and testimonials to get an idea of the lender’s reputation and customer service. This can help you choose a reliable lender with positive feedback from other borrowers. Step 4: Gather Required Documentation Commonly Required Documents To streamline the loan application process, gather all necessary documentation in advance. Commonly required documents include: Proof of Income: Recent pay stubs, tax returns, or bank statements. Identification: A valid government-issued ID such as a driver’s license or passport. Proof of Address: Utility bills or lease agreements to verify your residence. Credit Report: Some lenders may ask for a copy of your credit report. Step 5: Complete the Loan Application Online vs. In-Person Applications Many lenders, including Family Financial Loan Services, offer both online and in-person application options. Choose the method that is most convenient for you. Online applications can be completed from the comfort of your home, while in-person applications allow you to speak directly with a loan officer. Provide Accurate Information Fill out the loan application accurately and completely. Provide all requested information and double-check for errors. Incomplete or inaccurate applications can delay the approval process or result in denial. Submit Supporting Documents Submit all required supporting documents along with your application. Ensure that all documents are up-to-date and legible. Step 6: Review Loan Terms Understand the Terms and Conditions Once your loan application is approved, carefully review the loan terms and conditions. Pay attention to the interest rate, repayment schedule, fees, and any penalties for late payments or early repayment. Ask Questions If any terms are unclear, don’t hesitate to ask the lender for clarification. It’s important to fully understand your obligations before accepting the loan. Consider Total Loan Costs Calculate the total cost of the loan, including interest and fees, to ensure that it fits within your budget. Use online calculators or consult with a financial advisor if needed. Step 7: Accept the Loan Sign the Loan Agreement If you are satisfied with the loan terms, sign the loan agreement to accept the loan. Keep a copy of the agreement for your records. Receive Funds Once the agreement is signed, the lender will disburse the loan funds to your bank account. The time it takes to receive the funds can vary, but it’s typically within a few business days. Step 8: Manage Your Loan Set Up Automatic Payments Consider setting up automatic payments to ensure you never miss a due date. This can help you avoid late fees and maintain a positive payment history. Track Your Repayments Keep track of your loan repayments and monitor your progress. Regularly review your loan statements to ensure all payments are correctly applied. Budget for Repayments Adjust your budget to accommodate your loan repayments. Prioritize loan payments to avoid financial strain and stay on track with your repayment plan. Communicate with Your Lender If you encounter any financial difficulties or have questions about your loan, communicate with your lender as soon as possible. Family Financial Loan Services is committed to supporting borrowers and may offer solutions such as payment extensions or modified repayment plans. Conclusion Applying for a personal loan in Batesville, Mississippi, involves several important steps, from assessing your financial situation and checking your credit score to researching lenders and completing the application process. By following these steps and preparing thoroughly, you can increase your chances of securing a personal loan that meets your needs and helps you achieve your financial goals. Family Financial Loan Services offers a variety of personal loan products and personalized support to guide you through the process. Contact them today to learn more about their loan options and how they can assist you in obtaining the financing you need. With the right approach and resources, you can successfully navigate the loan application process and enjoy the benefits of a personal loan tailored to your unique financial situation.

October 30, 2024

Securing a loan with bad credit can be challenging, but it’s not impossible. For residents of Batesville, Mississippi, understanding your options and taking the right steps can help you obtain the financial assistance you need despite having a low credit score. Family Financial Loan Services offers various loan products designed to accommodate different financial situations. In this blog, we’ll explore how to get approved for a loan with bad credit and provide practical tips to improve your chances of approval. Understanding Bad Credit What is a Bad Credit Score? A credit score is a numerical representation of your creditworthiness, ranging from 300 to 850. Scores below 580 are generally considered poor, which can make it difficult to qualify for traditional loans. Factors contributing to a low credit score include late payments, high credit card balances, bankruptcies, and other negative marks on your credit report. Impact of Bad Credit on Loan Approval Lenders use your credit score to assess the risk of lending you money. A low credit score signals higher risk, leading to higher interest rates, stricter terms, or outright denial of your loan application. However, some lenders, including Family Financial Loan Services, offer loan products specifically designed for individuals with bad credit. Steps to Get Approved for a Loan with Bad Credit 1. Assess Your Financial Situation Understand Your Needs Before applying for a loan, determine the exact amount you need and how you plan to use the funds. This helps you avoid borrowing more than necessary and reduces the overall cost of the loan. Review Your Finances Evaluate your current financial situation, including your income, expenses, and existing debts. Understanding your financial health will help you choose a loan amount and repayment term that you can afford. 2. Check Your Credit Report Obtain Your Credit Report Get a free copy of your credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) through AnnualCreditReport.com. Review your reports for accuracy and identify any errors or discrepancies. Dispute Errors If you find any inaccuracies on your credit report, dispute them with the respective credit bureau. Correcting errors can improve your credit score and increase your chances of loan approval. 3. Improve Your Credit Score Pay Down Existing Debts Reducing your overall debt can positively impact your credit score. Focus on paying down high-interest debts and credit card balances. Make Timely Payments Consistently making on-time payments for your bills and existing debts can gradually improve your credit score. Set up automatic payments or reminders to ensure you never miss a due date. Avoid New Credit Applications Refrain from applying for new credit accounts or loans shortly before applying for a new loan. Multiple credit inquiries within a short period can negatively impact your credit score. 4. Consider Alternative Lenders Family Financial Loan Services Family Financial Loan Services in Batesville, MS, offers loan products designed for individuals with bad credit. Their personalized service and flexible terms can help you secure the funds you need despite a low credit score. Online Lenders Some online lenders specialize in providing loans to borrowers with bad credit. Research and compare different lenders to find the best terms and interest rates. Credit Unions Credit unions often have more flexible lending criteria and may offer better terms for members with bad credit. Consider joining a local credit union and exploring their loan options. 5. Explore Secured Loans Using Collateral Secured loans require collateral, such as a car, savings account, or other valuable assets. Since the loan is backed by collateral, lenders may offer better terms and lower interest rates, even if you have bad credit. Types of Secured Loans Common types of secured loans include auto loans, home equity loans, and secured personal loans. Evaluate your assets and determine if you can use any as collateral to improve your loan terms. 6. Apply with a Co-Signer Benefits of a Co-Signer A co-signer with a strong credit history can improve your chances of loan approval and help you secure better terms. The co-signer agrees to take responsibility for the loan if you default, reducing the lender’s risk. Choosing a Co-Signer Select a co-signer who has good credit and is willing to share the responsibility of the loan. Ensure they understand the risks involved and the impact on their credit score. 7. Prepare a Strong Loan Application Gather Necessary Documentation Prepare all required documents before applying for a loan. Commonly required documents include proof of income, identification, and bank statements. Provide Accurate Information Ensure all information on your loan application is accurate and complete. Inaccurate or incomplete information can delay the approval process or result in denial. 8. Consider Peer-to-Peer Lending How Peer-to-Peer Lending Works Peer-to-peer lending platforms connect borrowers with individual investors willing to fund loans. These platforms often have more lenient credit requirements compared to traditional lenders. Benefits of Peer-to-Peer Lending Peer-to-peer lending can provide competitive interest rates and flexible terms for borrowers with bad credit. Research different platforms to find one that suits your needs. 9. Demonstrate Financial Stability Show Consistent Income Lenders look favorably on borrowers with stable and consistent income. Provide proof of steady employment or regular income to demonstrate your ability to repay the loan. Build an Emergency Fund Having an emergency fund shows lenders that you have a financial cushion to cover unexpected expenses, making you a lower-risk borrower. 10. Be Prepared for Higher Interest Rates Accept Higher Rates Initially With bad credit, you may need to accept a loan with a higher interest rate. Use this loan to improve your credit score by making timely payments, then consider refinancing at a lower rate in the future. Plan for Higher Payments Factor in the higher interest rate when calculating your monthly loan payments. Ensure you can comfortably afford these payments without compromising your other financial obligations. Conclusion Getting a loan with bad credit in Batesville, Mississippi, requires careful planning and consideration. By understanding your financial situation, checking your credit report, and exploring alternative lenders and loan options, you can increase your chances of securing the funds you need. Family Financial Loan Services is dedicated to helping individuals with bad credit access financial solutions tailored to their needs. Contact them today to learn more about their loan products and how they can assist you in achieving your financial goals despite having a low credit score. With the right approach and preparation, you can overcome the challenges of bad credit and obtain the loan you need.

October 2, 2024

Home improvements can significantly enhance the comfort, functionality, and value of your home. Whether you’re planning a major renovation or a minor upgrade, finding the right financing option is crucial. For residents of Batesville, Mississippi, Family Financial Loan Services offers a range of loan products tailored to meet your home improvement needs. This guide will explore the best loan options for home improvements, helping you make an informed decision and successfully fund your project. 1. Personal Loans Overview Personal loans are a versatile financing option that can be used for various purposes, including home improvements. They are typically unsecured, meaning you don’t need to use your home as collateral. Benefits Flexibility: Use funds for any home improvement project, from small upgrades to major renovations. No Collateral Required: Since personal loans are unsecured, you don't risk losing your home if you default. Fixed Interest Rates: Enjoy predictable monthly payments with fixed interest rates. Considerations Interest Rates: Personal loan interest rates may be higher than secured loan options, especially if you have a lower credit score. Loan Amounts: The loan amount you qualify for may be lower than what you could get with a home equity loan or line of credit. How to Apply Applying for a personal loan with Family Financial Loan Services is straightforward. You'll need to provide proof of income, identification, and details about your financial situation. The application can be completed online or in-person for your convenience. 2. Home Equity Loans Overview Home equity loans allow homeowners to borrow against the equity in their homes. These loans are secured by your property and typically offer lower interest rates than unsecured loans. Benefits Lower Interest Rates: Secured by your home, home equity loans often come with lower interest rates. Fixed Rates and Terms: Enjoy predictable monthly payments with fixed interest rates. Larger Loan Amounts: Borrow larger sums based on the equity in your home. Considerations Collateral Required: Your home serves as collateral, so you risk foreclosure if you default on the loan. Closing Costs: Similar to a mortgage, home equity loans may come with closing costs and fees. How to Apply To apply for a home equity loan, you’ll need to provide documentation such as proof of income, property valuation, and identification. Family Financial Loan Services can guide you through the process, ensuring you understand all terms and conditions. 3. Home Equity Line of Credit (HELOC) Overview A HELOC is a revolving line of credit secured by your home’s equity. It works similarly to a credit card, allowing you to borrow as needed up to a certain limit. Benefits Flexibility: Borrow only what you need, when you need it, and pay interest only on the amount borrowed. Lower Interest Rates: Typically lower than unsecured loan rates due to the secured nature of the loan. Access to Funds: As you repay the borrowed amount, the funds become available again during the draw period. Considerations Variable Interest Rates: HELOCs usually have variable interest rates, which can fluctuate over time. Collateral Required: Your home is used as collateral, so defaulting could lead to foreclosure. Complex Terms: Understanding the draw period and repayment terms can be complicated. How to Apply Applying for a HELOC involves providing similar documentation as a home equity loan. Family Financial Loan Services will help you navigate the application process and explain the terms and conditions clearly. 4. Cash-Out Refinance Overview Cash-out refinancing involves replacing your existing mortgage with a new one that has a higher loan amount. The difference is taken out in cash and can be used for home improvements. Benefits Lower Interest Rates: Mortgage rates are typically lower than personal loan rates. Tax Benefits: Interest paid on the new mortgage may be tax-deductible. Lump Sum Access: Receive a large sum of money upfront for extensive home improvement projects. Considerations Closing Costs: Refinancing involves closing costs similar to your original mortgage. Longer Repayment Term: Extending your mortgage term can mean paying more interest over time. Risk of Foreclosure: As with other secured loans, defaulting could result in losing your home. How to Apply To apply for a cash-out refinance, you’ll need to provide financial documentation and undergo a home appraisal. Family Financial Loan Services can assist with the application and ensure you understand all the associated costs and benefits. 5. FHA 203(k) Rehab Loan Overview The FHA 203(k) loan is a government-backed loan specifically for home renovations. It combines the cost of the home purchase or refinance with the renovation costs into a single mortgage. Benefits Government-Backed: Easier qualification requirements due to FHA backing. Lower Down Payments: Lower down payment requirements compared to conventional loans. Combines Purchase and Renovation: Ideal for buying a fixer-upper and financing the improvements. Considerations Strict Guidelines: FHA 203(k) loans have specific guidelines and eligible repairs. Additional Paperwork: More documentation and inspections are required compared to other loan types. Mortgage Insurance: Borrowers are required to pay mortgage insurance premiums. How to Apply Applying for an FHA 203(k) loan involves finding an FHA-approved lender, providing necessary documentation, and getting quotes from contractors for the proposed work. Family Financial Loan Services can help you understand the requirements and guide you through the application process. 6. Personal Line of Credit Overview A personal line of credit functions similarly to a credit card, providing you with access to funds up to a certain limit. It is an unsecured loan, making it more flexible but usually with higher interest rates than secured loans. Benefits Flexibility: Borrow only what you need and pay interest only on the amount used. No Collateral Required: As an unsecured loan, you don’t risk losing your home. Revolving Credit: Funds become available again as you repay the borrowed amount. Considerations Higher Interest Rates: Generally higher than secured loan options. Variable Rates: Interest rates may fluctuate over time. Credit Requirements: May require a higher credit score to qualify. How to Apply To apply for a personal line of credit, you’ll need to provide proof of income and identification. Family Financial Loan Services offers a straightforward application process, helping you access funds quickly and easily. Conclusion Choosing the right loan for your home improvement project in Batesville, Mississippi, involves considering various factors such as the loan amount, interest rates, repayment terms, and whether you’re comfortable using your home as collateral. Family Financial Loan Services offers a range of loan products tailored to meet your needs, from personal loans and home equity loans to HELOCs and cash-out refinancing. By understanding the benefits and considerations of each loan type, you can make an informed decision that aligns with your financial situation and home improvement goals. Contact Family Financial Loan Services today to learn more about their loan options and how they can help you finance your next home improvement project. With the right financing and careful planning, you can enhance your home’s comfort, functionality, and value.

September 18, 2024

Interest rates are a crucial factor in determining the overall cost of a loan. For residents of Batesville, Mississippi, understanding how interest rates work and how they impact your loan can help you make informed financial decisions. Family Financial Loan Services offers a variety of loan products with competitive interest rates. This guide will help you understand interest rates for loans, the factors that influence them, and tips for securing the best rates in Batesville, MS. What Are Interest Rates? Definition Interest rates represent the cost of borrowing money from a lender, expressed as a percentage of the loan amount. They can be fixed or variable and are typically quoted on an annual basis, known as the annual percentage rate (APR). Fixed vs. Variable Interest Rates Fixed Interest Rates: These rates remain constant throughout the life of the loan, providing stability and predictable monthly payments. Variable Interest Rates: These rates can fluctuate based on changes in a benchmark interest rate, such as the prime rate or LIBOR, leading to varying monthly payments. Factors Influencing Interest Rates Credit Score Your credit score is one of the most significant factors lenders consider when determining your interest rate. A higher credit score indicates lower risk to the lender, often resulting in lower interest rates. Excellent Credit (750-850): Typically qualifies for the lowest interest rates. Good Credit (700-749): Generally qualifies for competitive interest rates. Fair Credit (650-699): May qualify for higher interest rates. Poor Credit (300-649): Likely to face the highest interest rates or potential loan denial. Loan Amount and Term The amount you borrow and the length of the loan term can impact your interest rate. Larger loan amounts or longer terms may come with higher rates due to the increased risk for the lender. Shorter Terms: Often come with lower interest rates but higher monthly payments. Longer Terms: Typically have higher interest rates but lower monthly payments. Debt-to-Income Ratio (DTI) Lenders assess your debt-to-income ratio to determine your ability to repay the loan. A lower DTI ratio (below 36%) is preferable and can help you secure a better interest rate. Type of Loan Different types of loans come with varying interest rates. Secured loans, such as auto loans or home equity loans, often have lower interest rates compared to unsecured loans like personal loans or credit cards. Economic Conditions Broader economic factors, such as inflation and central bank policies, also influence interest rates. In a rising interest rate environment, lenders may increase rates to compensate for higher inflation and borrowing costs. How Interest Rates Impact Loan Costs Total Interest Paid The interest rate significantly affects the total interest paid over the life of the loan. Even a slight difference in the interest rate can lead to substantial savings or additional costs. Example Calculation For example, consider a $20,000 loan with a 5-year term: At 5% Interest: Total interest paid = $2,645 At 7% Interest: Total interest paid = $3,760 Monthly Payments Interest rates also impact your monthly loan payments. Lower interest rates result in lower monthly payments, making the loan more affordable. Example Calculation Using the same $20,000 loan example: At 5% Interest: Monthly payment = $377 At 7% Interest: Monthly payment = $396 Tips for Securing the Best Interest Rates Check and Improve Your Credit Score Review Your Credit Report: Obtain a free copy of your credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) through AnnualCreditReport.com. Check for errors and dispute any inaccuracies. Pay Down Debt: Reduce your overall debt to improve your credit score and lower your debt-to-income ratio. Make Timely Payments: Consistently making on-time payments for your bills and existing loans can gradually improve your credit score. Compare Lenders Shop Around: Research and compare loan offers from multiple lenders, including banks, credit unions, and online lenders. Family Financial Loan Services in Batesville, MS, offers competitive rates and personalized service. Use Online Comparison Tools: Utilize online tools to evaluate loan rates and terms from various lenders. These tools can help you quickly identify the best offers based on your financial situation. Choose the Right Loan Type Secured Loans: Consider using collateral to secure a loan, which can result in lower interest rates. Examples include auto loans, home equity loans, and secured personal loans. Fixed vs. Variable Rates: Decide whether a fixed or variable interest rate is better suited to your financial situation. Fixed rates provide stability, while variable rates may offer initial savings with potential fluctuations. Get Pre-Approved Benefits of Pre-Approval: Getting pre-approved for a loan gives you a clear idea of the loan amount and interest rate you qualify for. It also demonstrates to sellers that you’re a serious buyer with secure financing. How to Get Pre-Approved: To get pre-approved, you’ll need to provide documentation such as proof of income, employment verification, and credit history. Family Financial Loan Services can guide you through this process. Negotiate with Lenders Leverage Competing Offers: Use offers from other lenders as leverage to negotiate better terms and rates with your preferred lender. Ask for Discounts: Inquire about any available discounts, such as loyalty discounts for existing customers or rate reductions for automatic payments. Make a Larger Down Payment Reduce Loan Amount: Making a larger down payment reduces the amount you need to borrow, which can lead to a lower interest rate. Lower Risk: A larger down payment reduces the lender’s risk, as there is more equity in the asset being financed. This increased security can result in more favorable loan terms and interest rates. Opt for a Shorter Loan Term Lower Interest Rates: Shorter loan terms often come with lower interest rates because the lender’s risk is reduced over a shorter period. Total Interest Savings: Opting for a shorter loan term can lead to significant savings on the total interest paid. Maintain a Stable Financial Profile Stable Income: A stable and reliable income stream can positively impact your loan application. Lenders prefer borrowers with consistent income, as it indicates the ability to make regular loan payments. Low Debt Levels: Maintaining low debt levels and managing your financial obligations responsibly can improve your financial profile and increase your chances of securing favorable loan terms. Emergency Fund: Having an emergency fund demonstrates financial stability and responsibility. Lenders view borrowers with savings as lower risk, which can lead to better loan offers. Conclusion Understanding interest rates for loans in Batesville, Mississippi, is essential for making informed borrowing decisions. By knowing the factors that influence interest rates and how they impact loan costs, you can take proactive steps to secure the best rates. Family Financial Loan Services offers a variety of loan products with competitive interest rates and personalized support to help you achieve your financial goals. Contact them today to learn more about their loan options and how they can assist you in securing the best interest rates. With the right approach and resources, you can make informed borrowing decisions and enjoy the benefits of lower interest rates and favorable loan terms.

August 28, 2024

Selecting the right loan can significantly impact your financial health and help you achieve your goals more efficiently. With various loan options available, it's essential to understand your needs and evaluate the terms and conditions before making a decision. For residents of Batesville, Mississippi, Family Financial Loan Services offers a wide range of loan products tailored to meet diverse financial needs. This guide will help you navigate the process of choosing the right loan in Batesville, MS, ensuring you make an informed decision that aligns with your financial situation and objectives. 1. Assess Your Financial Needs Define the Purpose Before applying for a loan, clearly define what you need the funds for. Different types of loans cater to various needs, so identifying the purpose will help you choose the most suitable option. Common reasons for taking out a loan include: Debt Consolidation: Combining multiple debts into a single loan with a lower interest rate. Home Improvements: Financing renovations, repairs, or upgrades to increase your home's value. Medical Expenses: Covering unexpected medical bills or elective procedures not covered by insurance. Major Purchases: Funding significant expenses such as appliances, furniture, or electronics. Emergency Expenses: Managing unexpected financial emergencies, such as car repairs or urgent travel. Business Needs: Supporting business expansion, purchasing equipment, or managing cash flow. Determine the Loan Amount Calculate the exact amount you need to borrow. Borrowing too much can lead to higher monthly payments and increased interest costs, while borrowing too little may not fully cover your expenses. Create a detailed budget that outlines your income, expenses, and the specific amount you need to borrow. 2. Understand Different Types of Loans Personal Loans Personal loans are versatile, unsecured loans that can be used for a variety of purposes. They typically come with fixed interest rates and repayment terms, making them predictable and easy to manage. Best For: Debt consolidation, home improvements, medical expenses, major purchases, and emergency expenses. Pros: No collateral required, fixed interest rates, predictable payments. Cons: Requires good credit for favorable rates, potential origination fees. Cash Loans Cash loans, also known as payday loans, are short-term loans designed to provide immediate financial relief. They are typically repaid on your next payday and are ideal for covering unexpected expenses. Best For: Emergency expenses and short-term financial needs. Pros: Fast approval and funding, minimal credit requirements. Cons: High interest rates, short repayment terms. Same-Day Loans Same-day loans offer quick access to funds, typically within hours of application. These loans are ideal for urgent financial needs and provide immediate financial assistance. Best For: Immediate financial emergencies and unexpected expenses. Pros: Rapid access to funds, simple application process. Cons: Higher interest rates, short repayment periods. Payday Loans Payday loans are small, short-term loans intended to cover expenses until your next payday. They are known for their quick approval and funding process. Best For: Temporary financial shortfalls and urgent bills or expenses. Pros: Easy qualification, fast funding. Cons: High interest rates, must be repaid quickly. Auto Loans Auto loans are secured loans specifically for purchasing a vehicle. The vehicle itself serves as collateral, which can result in lower interest rates compared to unsecured loans. Best For: Purchasing a new or used vehicle. Pros: Lower interest rates, flexible terms, fixed monthly payments. Cons: Requires collateral, potential for repossession if defaulted. Business Loans Business loans provide financing for various business needs, from expanding operations to purchasing equipment. These loans can be secured or unsecured, depending on the amount and purpose of the loan. Best For: Business expansion, equipment purchases, managing cash flow. Pros: Supports business growth, flexible use of funds, tailored solutions. Cons: May require collateral, detailed documentation needed. Home Equity Loans Home equity loans allow homeowners to borrow against the equity in their homes. These loans are secured by the home and can be used for significant expenses like home improvements or debt consolidation. Best For: Large expenses such as home renovations or consolidating high-interest debt. Pros: Lower interest rates, potential tax benefits, large loan amounts. Cons: Requires collateral, risk of foreclosure if defaulted. 3. Evaluate Loan Terms and Conditions Interest Rates Compare the interest rates offered by different lenders. Lower interest rates reduce the overall cost of the loan, making it more affordable. Consider both fixed and variable rates: Fixed Rates: Provide stability with consistent monthly payments. Variable Rates: May start lower but can fluctuate based on market conditions. Repayment Terms Consider the loan’s repayment term and how it fits into your budget. Shorter terms typically have higher monthly payments but lower total interest costs. Longer terms have lower monthly payments but can be more expensive overall due to interest. Fees and Charges Be aware of any fees associated with the loan, such as origination fees, prepayment penalties, or late payment charges. These additional costs can affect the affordability of the loan. Loan Amount Ensure the loan amount meets your needs without encouraging over-borrowing. Borrowing more than necessary can lead to higher repayments and increased financial strain. Lender Reputation Choose a reputable lender with positive customer reviews and a track record of transparent and fair practices. Family Financial Loan Services in Batesville, MS, is known for its customer-focused approach and reliable loan products. 4. Check Your Credit Score Importance of Credit Score Your credit score impacts your loan eligibility and the interest rate you’ll be offered. A higher credit score can lead to better loan terms and lower interest rates. How to Check Your Credit Score You can obtain a free credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) once a year through AnnualCreditReport.com. Review your credit report for accuracy and address any discrepancies that may negatively impact your score. Improving Your Credit Score If your credit score is lower than desired, take steps to improve it before applying for a loan: Pay Down Existing Debts: Reducing your overall debt can improve your credit score. Make Timely Payments: Consistently making on-time payments for your bills and existing debts can gradually improve your credit score. Avoid Opening Too Many New Accounts: Multiple credit inquiries within a short period can negatively affect your credit score. 5. Get Pre-Approved for a Loan Importance of Pre-Approval Getting pre-approved for a loan gives you a clear idea of how much you can borrow and the interest rate you’ll be offered. This step also demonstrates to sellers that you’re a serious buyer with secure financing. How to Get Pre-Approved To get pre-approved, you’ll need to provide documentation such as proof of income, employment verification, and credit history. Family Financial Loan Services in Batesville, MS, can guide you through this process, ensuring you have all the necessary paperwork and information. 6. Compare Loan Offers Shop Around Don’t settle for the first loan offer you receive. Compare loan terms, interest rates, and fees from multiple lenders. Use online comparison tools and consult with financial advisors to find the best deal. Evaluate Total Loan Costs Consider the total cost of the loan, including the interest rate, loan term, and any additional fees. The annual percentage rate (APR) provides a comprehensive view of the loan’s cost over time. Read the Fine Print Carefully review all terms and conditions of the loan agreement. Ensure you understand the interest rate, repayment schedule, fees, and any penalties for late payments or early repayment. Ask questions if any terms are unclear. 7. Apply for the Loan Gather Necessary Documentation Prepare all required documents for your loan application, including proof of income, identification, and financial statements. Having these documents ready can streamline the loan application process. Complete the Application Submit your loan application with accurate and complete information. Family Financial Loan Services offers both online and in-person application options for your convenience. Review and Sign the Agreement Once your loan is approved, carefully review the loan agreement. Ensure you understand all terms and conditions before signing. Keep a copy of the agreement for your records. Conclusion Choosing the right loan in Batesville, Mississippi, involves careful consideration of your financial needs, understanding different loan types, evaluating loan terms, and comparing offers from multiple lenders. By following these steps, you can secure a loan that aligns with your financial situation and helps you achieve your goals. Family Financial Loan Services in Batesville, MS, offers a variety of loan products and personalized support to guide you through the process. Contact them today to learn more about their loan options and how they can assist you in making informed borrowing decisions. With the right approach and resources, you can confidently choose the best loan for your needs and enjoy the benefits of financial stability and success.

Business Hours

- Mon - Fri

- -

- Sat - Sun

- Closed

Business Hours

- Mon - Fri

- -

- Sat - Sun

- Closed

Contact Info

474 Hwy. 6 East, Suite C,

Batesville, MS 38606

Quick Links

© 2025

All Rights Reserved | Family Financial Services, Inc. | Site Creds